Are you looking to take the plunge into investing? There are some great new tools out right now to help you start off and get your feet wet. Although most basic investment accounts today have minimum requirements that are generally at least $500 that doesn’t have to stop you. There is a whole new crop of cheap and user friendly apps that allow novice investors to get started. Plus, they are also budget friendly.

Here are just a few we like:

Acorns

With Acorns, you’ll just connect your credit or debit card to the app so when you make a purchase when you are out shopping that doesn’t come out to a round number the Acorns app takes the leftover change and saves it for you.

Then once you’ve accumulated $5, it will deposit the money in one of five investment accounts of your choosing. When you sign up you select these accounts ranging from conservative to super aggressive investments.

The best part? Acorns charges no fees. That’s right-ZERO fees for students under 24.

For the rest of us, it’s only $1 a month and that changes to 0.25% of your total assets per year once you’ve saved $5,000 in the account.There are also no fees if you decide to withdraw funds.

This is great for those that have a “set it and forget it” motivation. You’ll be saving without every realizing it.

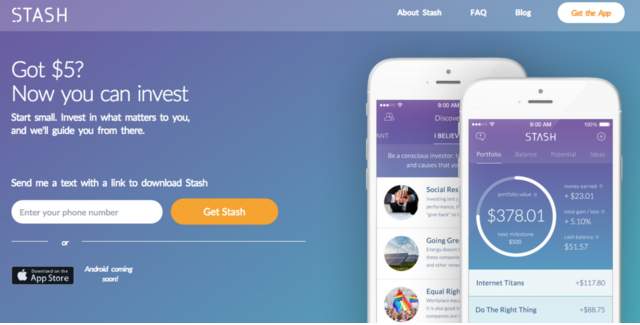

Stash

Stash is the new app and it’s pretty cool for those wanting to get your feet wet. You can start investing in ETFs and stocks for as little as $5 bucks. This is because Stash lets you buy a fraction of a share if you can’t afford the whole thing. So that means you can get a little piece of the pie really easy.

There is currently no other investing app that does this yet. Similar to the Acorns app, Stash charges you just $1 a month which they take out of your bank account and not your investments, until you hit $5,000. After that, you are just charged 0.25% per year.

This is an easy way for you to get multiple parts of stocks and let you play the field until you find what you like to invest in. It really helps take the confusion out of buying stocks and investing for those that are just starting out.

Stash will also help you pick the right investments. When you register, Stash asks you some questions about what type of investor you are and this allows the app to gauge how much risk you should take and how much you’re comfortable with. This way you don’t ever feel uncomfortable with the investments it makes for you.

Then it will recommend a conservative, moderate or aggressive portfolio depending on those answers. Currently, there are only 30 funds to choose from so you’re less likely to feel overwhelmed if you have never invested.

All of the funds share one common thread that makes it easy for you to pick based on your interests. Here’s an example: Stash’s “Internet Titans” fund is invested in companies that do the majority of their business online. It’s nice that they are grouped like this and again, if you are just starting out, a lot less intimidating.

For both of these apps it is good to read their FAQ’s so that you get all of the information.