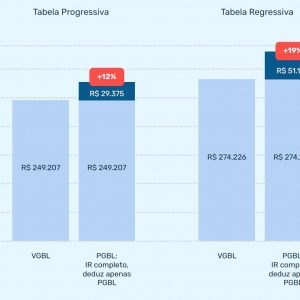

When it come comes to this earnings season, the S&P 500 companies are expected to see profits drop by nearly 6%.

It’s the top line of companies’ income statements that could actually be the biggest concern for all of us.

Currently, third-quarter revenues are projected to fall to about 3.3% from the third quarter of last year. Then following a 3.3% decline in Quarter two and a about a 2.8% drop in Quarter 1, according to FactSet. The thing is analysts aren’t expecting a turnaround anytime soon, so with fourth-quarter revenues projected to decline 1.6 percent things are not going up anytime soon.

Looking historically at it last time revenues ran four negative quarters in a row was 2008 to 2009.

When you see two consecutive quarters of negative GDP growth mark in any economic recession, the extended fall of revenue has been referred to as a “revenue recession.”

This is also showing that on average consumers still don’t have the ability to pay full price for a product which forces companies to discount them in order to move the merchandise. The only way this can be resolved is to see people making more income, thus having more to spend.

Also affecting the decline in revenue are notably lower oil prices and some fluctuations in the U.S. dollar against other currencies world wide.

To read more on the revenue ‘revenue recession’ got to CNBC.com