Home buying can be a leap of faith for some. If you are looking to become a homeowner you don’t want to end up house poor or stuck in a situation where you owe more than the actual house is worth.

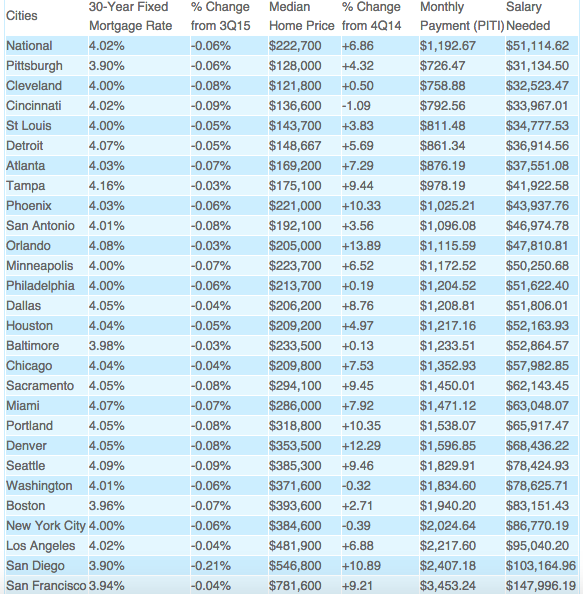

Right now, to afford the national median home price of $222,700, you’ll need an annual salary of $51,115. The U.S. Census Bureau reported in September 2014 that: U.S. real (inflation adjusted) median household income was $51,939 in 2013 versus $51,759 in 2012, statistically unchanged. In 2013, real median household income was 8.0 percent lower than in 2007, the year before the latest recession. So most can swing buying the house however there is more that goes into home ownership than just making the buy. You’ve got taxes, insurance, upkeep and then the bills that go with having a home.

However the average might be $222,700 but that is not the actual price of homes in every city in every state. As they say “Location, Location, Location” is key to finding an affordable home. Here’s how much you need to earn to afford buying a home in 27 metro areas across the country, according to HSH.com.

As you can see, the amount you need to make get’s bigger towards the bottom of the list. It’s a wonder anyone can afford a home in say San Francisco where they say you need to make about $148K to own a home. That $3,453.24 price tag is just the mortgage so you are easily paying $6000 a month when you factor in property taxes, insurance and normal house upkeep.

Knowing how many American’s are struggling just to pay for food and other basics, you can understand why many struggle. It’s surely a hard nut to crack when you realize that if you want to live in Los Angeles, you are paying for the pleasure of your zip code than a home.

Notes/Methodology

*Average jumbo mortgage rate used; HSH.com determined the yearly before-tax salary a buyer would need to afford the total cost (including, principal, interest, tax and insurance) of a median-priced home in the 27 largest U.S. markets based on population. HSH used the average interest rate for a 30-year fixed-rate mortgage in the fourth quarter 2015, and assumed buyers would make a 20% down payment and spend no more than 28% of their gross income for housing. Median home prices are for the fourth quarter of 2015 and from the National Association of Realtors.